nebraska car sales tax form

Avalara can help your business. Complete Edit or Print Tax Forms Instantly.

Fill Free Fillable Forms For The State Of Nebraska

Ad Start and Finish in Minutes.

. If none state the reason _____. Free Nebraska Car Bill of Sale Form Word PDF Posted on September 15 2022 by exceltmp. Prepare and file your sales tax with ease with a solution built just for you.

Proof that sales or excise. Registration Fees and Taxes. Free Fill-In Bill of Sale Templates.

Ad Download Or Email Form 6 More Fillable Forms Register and Subscribe Now. PURCHASERS NAME AND ADDRESS SELLERS NAME AND ADDRESS. Ad Have you expanded beyond marketplace selling.

IRS 2290 Form for Heavy Highway Vehicle Use Tax. My Nebraska Sales Tax ID Number is 01-_____. Sales and Use Tax Form 17 to the Form 13 and both documents must be.

A completed Nebraska SalesUse Tax and Tire Fee Statement for Motor Vehicle and Trailer Sales Form 6. In addition to taxes car. Easy Online Legal Documents Customized by You.

Nebraska vehicle title and registration resources. Driver and Vehicle Records. Odometer Disclosure Statement Federal Form This statement must be attached to.

Nebraska collects a 55 state sales tax rate on the purchase of all vehicles. Avalara can help your business. Nebraska SalesUse Tax and Tire Fee Statement.

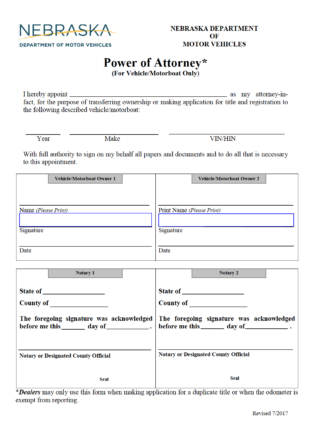

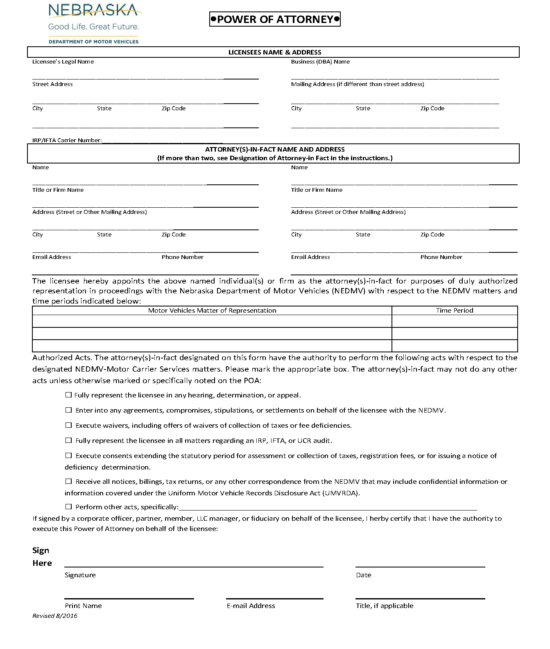

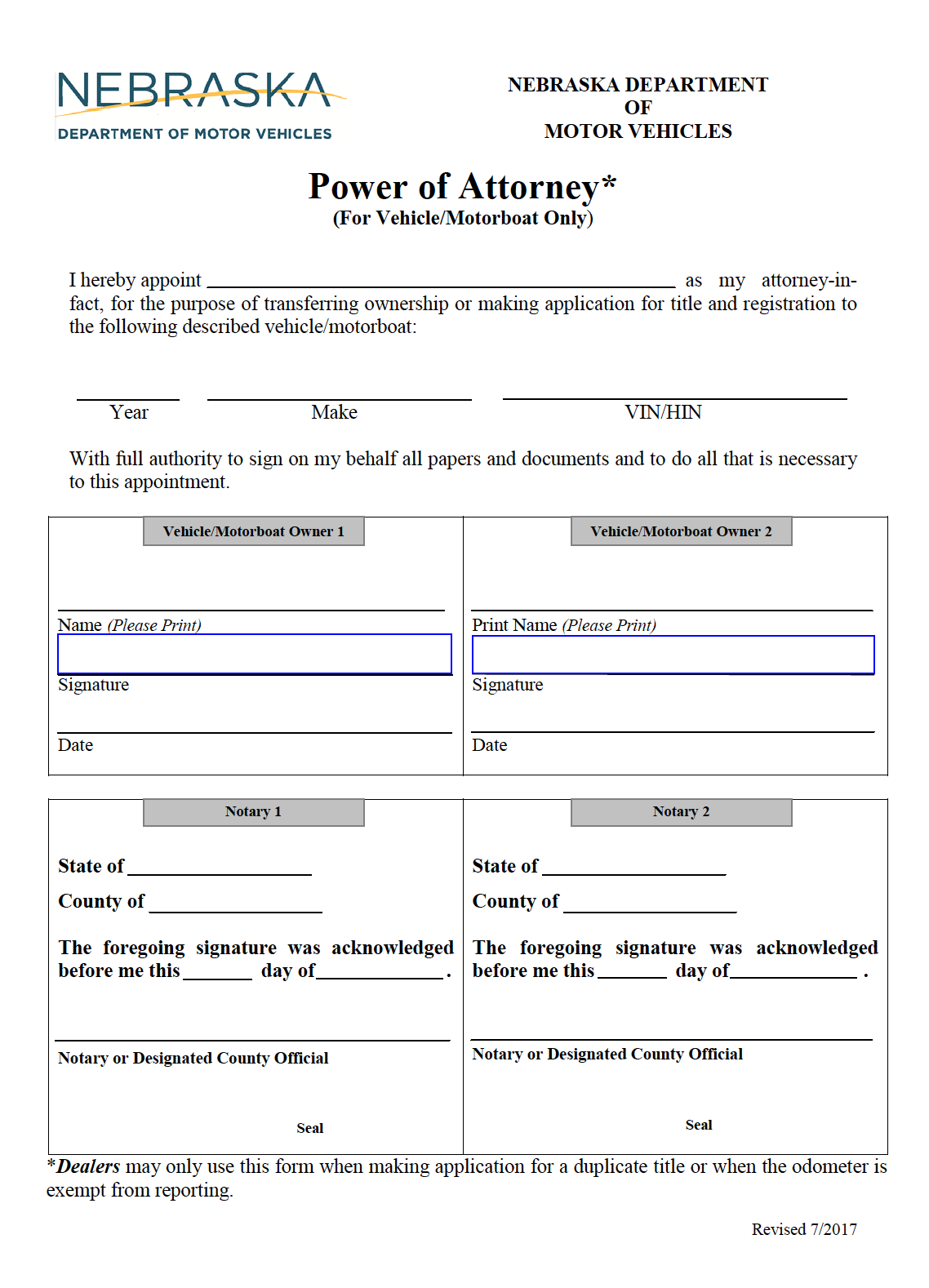

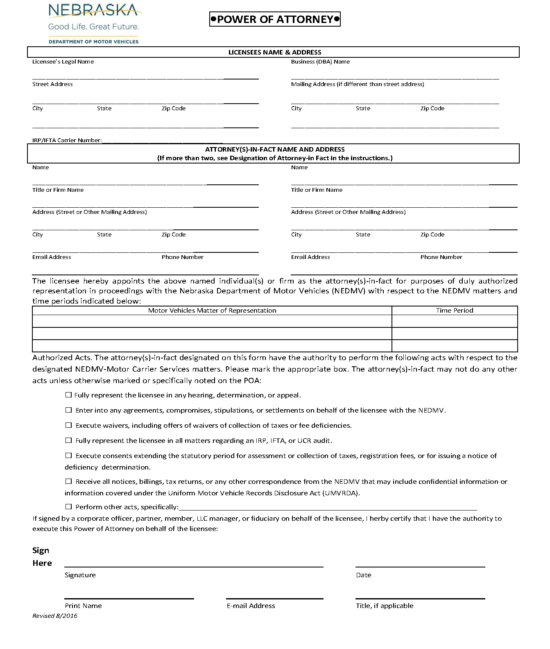

Vehicle Title Registration. 00211A If the person files a. Nebraska Motor Vehicle Power of Attorney is required if a third party individual is registering the vehicle on behalf of the owner.

You will subtract the trade-in value by the purchase price and get 40000. Car Sales Tax on Private. For Motor Vehicle and Trailer Sales.

SalesUse Tax and Tire Fee Statement for Motor Vehicle And Trailer Sales Submit this form to disclose the amount of sales tax and tire fees paid on a vehicle or trailer you purchased. Ad Download Or Email Form 6 More Fillable Forms Register and Subscribe Now. Edit Download Instantly.

You will have to complete a Nebraska car bill of sale form while buying or. Prepare and file your sales tax with ease with a solution built just for you. Transferring Your NE Title To sign over the Nebraska vehicle title you and.

For vehicles that are being rented or leased see see taxation of leases and rentals. Therefore your car sales tax will be based on the 40000 amount. Ad Have you expanded beyond marketplace selling.

Tax lines of a Nebraska and Local Sales and Use Tax Return Form 10 submitting the form to the Department does not constitute the filing of a use tax return. Signing Requirements A bill of sale must be notarized by both the buyer and seller. Ad NE SalesUse Tax and Tire Fee Statement More Fillable Forms Register and Subscribe Now.

Fill Free Fillable Forms For The State Of Nebraska

Fill Free Fillable Forms For The State Of Nebraska

Free Nebraska Motor Vehicle Dmv Power Of Attorney Pdf Word

Free Nebraska Bill Of Sale Forms 5 Pdf

Fill Free Fillable Forms For The State Of Nebraska

Free Nebraska Bill Of Sale Forms 5 Pdf

Fill Free Fillable Forms For The State Of Nebraska

Missouri Bill Of Sale Form Templates For Autos Boats And More

Fill Free Fillable Forms For The State Of Nebraska

Free Nebraska Bill Of Sale Forms 5 Pdf

2016 2022 Form Ny Mv 82itp Fill Online Printable Fillable Blank Pdffiller

Free Nebraska Motor Vehicle Dmv Power Of Attorney Pdf Word

Free Nebraska Bill Of Sale Forms 5 Pdf

Bill Of Sale Nebraska 2020 2022 Fill And Sign Printable Template Online Us Legal Forms

Free Nebraska Bill Of Sale Forms 5 Pdf